Investing in real estate has long been seen as a path to financial growth and stability, but success in this field rarely comes from luck alone. Without a detailed understanding of markets, property conditions, and financial risks, even experienced investors can face significant losses.

Research acts as the foundation for every sound investment strategy, guiding decisions from property selection to long-term portfolio management. It allows investors to identify opportunities that align with their financial goals while minimizing exposure to pitfalls. Through careful research, every element of a real estate investment plan can be evaluated, increasing the likelihood of sustainable returns.

Understanding Local Market Trends

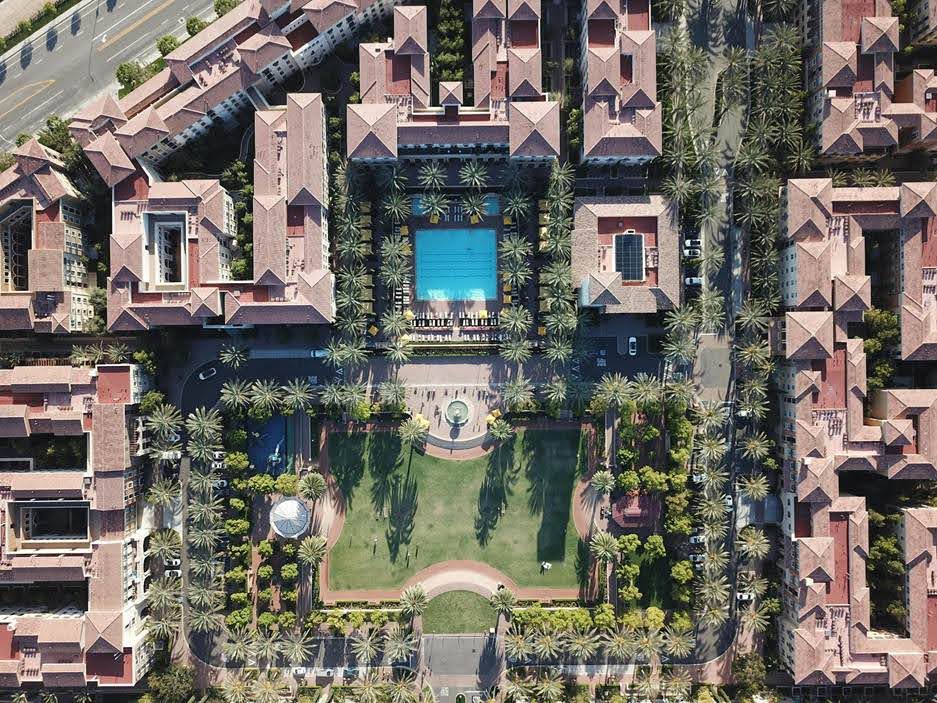

Grasping local market trends is crucial for making informed real estate decisions, as it provides insight into supply, demand, pricing patterns, and neighborhood development. Investors exploring opportunities can use online tools like www.binghatti.com/en/property-search to examine current listings, compare property values, and observe emerging hotspots within a specific area. Tracking these trends allows buyers to identify locations with growth potential and avoid markets that may stagnate.

Demographics, economic indicators, and upcoming infrastructure projects all influence property values and rental demand. A clear understanding of these local factors helps investors select properties that align with their goals while mitigating financial risks and uncertainties.

Evaluating Property-Specific Factors

Once a target market is selected, research must shift to individual properties. Examining property age, construction quality, maintenance history, and potential for renovations can reveal hidden costs and opportunities. A property that appears attractive in terms of price may involve significant expenses that erode returns, while properties with untapped potential can provide above-average growth.

Investors often use tools such as property inspections, appraisal reports, and comparative market analyses to assess value accurately. Understanding these specifics helps investors make informed choices that align with long-term investment objectives.

Analyzing Financial Viability

A real estate investment plan cannot succeed without a clear picture of financial feasibility. Detailed research into mortgage rates, financing options, tax implications, and projected cash flows ensures that the investment aligns with budget and risk tolerance. Tools like financial modeling and scenario analysis allow investors to forecast potential outcomes and adjust strategies accordingly.

Considering factors such as interest rate fluctuations, vacancy periods, and maintenance costs provides a realistic view of expected returns. Investors who neglect financial analysis often face unexpected setbacks, highlighting why careful research is crucial before committing funds.

Assessing Legal and Regulatory Considerations

Understanding local laws, zoning regulations, and property rights forms another critical aspect of research. Real estate investments operate within a framework of legal requirements that, if ignored, can lead to fines, legal disputes, or limitations on property use. Research into building codes, landlord-tenant laws, and environmental regulations ensures that investments comply with all requirements.

Engaging legal professionals or consulting local authorities can clarify potential restrictions and obligations. By addressing these factors in advance, investors avoid legal pitfalls that could compromise their plans and protect their assets. A clear grasp of these rules supports smoother decision-making throughout the entire investment process.

Studying Historical Performance and Comparable Investments

Examining the historical performance of similar properties and investment strategies provides valuable context. Comparing returns, occupancy rates, and market resilience helps investors set realistic expectations and refine their approach.

This research often uncovers patterns that may not be apparent from current market conditions alone, such as seasonal demand shifts or long-term neighborhood growth trends. Understanding how similar investments have performed under different economic circumstances allows investors to adjust their strategy proactively, increasing the likelihood of steady returns.

Considering Long-Term Economic and Social Factors

Beyond immediate property and financial considerations, broader economic and social trends can influence real estate success. Population growth, employment trends, infrastructure development, and lifestyle changes all impact demand for housing and commercial spaces. Researching these macro-level factors helps investors anticipate market shifts and identify properties with sustainable growth potential.

For example, a neighborhood attracting new businesses or improved transportation links may offer higher long-term returns. Investors who incorporate these perspectives into their planning position themselves to benefit from changing market conditions rather than reacting after changes occur.

Research forms the backbone of any effective real estate investment strategy, connecting local market analysis, property evaluation, financial assessment, legal compliance, historical data, and economic trends. Skipping or minimizing this step exposes investors to unnecessary risks, while diligent research allows for evidence-based decision-making that supports sustainable growth.

Every detail uncovered through careful analysis can guide strategy, optimize returns, and reduce potential pitfalls. Real estate success does not rely solely on opportunity but on the investor’s ability to understand and act upon the insights uncovered through consistent and thorough research.